Tougher Australian tax rules imposed on non-resident property investors

Here is an article that appeared in the Singapore Business Review that featured TJD Accounting Services on the topic of taxation for Non-Resident Property Investors. For the reading purpose of our clients from all over the world, we have re-written the article to address all overseas and non-resident property investors, not just Singaporen investors. If…

Read MoreOverseas Property Investors – Beware of high taxes (by Karina Foo)

Overseas Investors with Australian property – Beware of taxes (Read our article that appeared in The Star Publications, Malaysia). Click here to Download the article from The Star Publications: Overseas Property Investors beware of Australian taxes Text from article: Investors with Australian property: Beware of Australian Taxes By Karina Foo MALAYSIAN property investors with assets…

Read MoreOverseas Property Investors in Australia Face Critical Tax Challenges by 2025

Overseas Property Investors in Australia who may find it tough to hold onto their properties will continue to face bigger challenges by January 2025 The complex and ever-evolving tax landscape in Australia is confronting a large number of overseas property investors in Australia as these implications are significantly impacting their invesments. Recent changes announced in…

Read MoreHow are Foreign Investors Taxed in Australia?

Australia’s taxation system is one of the most complex yet structured in the world, and it may be even harder to understand for foreign investors. If you are not an Australian resident and have an investment in the country, particularly property, you need to know what your tax obligations are. This guide reviews some of…

Read MoreDo Foreign Investors Pay Capital Gains Tax in Australia?

In short: Yes. And there’s no escaping it. As a foreign property investor in Australia, you are subject to Capital Gains Tax (CGT). While you do not pay for the Medicare Levy, your taxes from any income as a non-resident still applies with the following income tiers: $0 – $135k = 30 cents to a…

Read MoreWhat Are the New Foreign Investor Tax Rules in Australia?

Are you a foreign investor in Australian property? If so, it is imperative that you understand your tax obligations in Australia to avoid penalties and unnecessary high tax debt. From JANUARY 1st, 2025, the Australian Tax Office (ATO) is expected to announce big changes on withholding tax that will affect all overseas investors. This article…

Read MoreMoonee Valley News | Keilor Road

Moonee Valley Update | Keilor Road Accountant Region Articles The first of our website articles on news from around six of the councils where the majority our clients live or have their businesses. Our first post is close to home as we see it every day. When we travel to work, or look out the…

Read MoreEssendon Accountant | Searching For Accountant Near Me

Essendon Accountant Accountant Near Me Essendon accountant or accountant near me are the two of the three most common searches on the Internet for an accountant in the Essendon area. The third most popular search is accountants Essendon. The TJD Accounting Services website should provide you with all the information you need on our tax…

Read MoreHow to help your child with their first tax return

First tax return for your children Have you got taxation block? Especially when this is one of your children’s first tax return. Tax time and as parents we’ve done our ATO taxation return for years and no longer need to think about what is required of us. Tax returns for us has become automatic. Are…

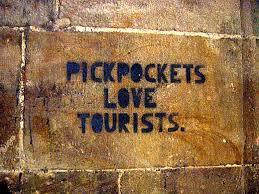

Read MoreAre You Planning A Trip Overseas?

Best Ways to Take Money Overseas Protect You Assets Has one of your children has decided to take a trip overseas, do you know the best ways to take money overseas? Read on so you can assist them with protection of their assets while they are abroad. In the past we’ve discussed the concept of…

Read More