Asset protection

Trust Structures for Non-Resident Property Owners: What Non-Resident Investors Must Know

As non-resident interest in Australian property continues to grow, the decision about trust structures (ownership structures) has become more important than ever. For non-resident property owners, using a trust can offer benefits like asset protection, tax planning, and succession flexibility. But setting up a trust as a non-resident isn’t simple. New tax laws and rising…

Read MoreThe Great Tax Divide: Big Corporations pay $100 billion tax but Small Individual Tax Payers pay $330 billion

The Australian tax system has long been a contentious topic, especially when it comes to the disparity between what small taxpayers contribute and the relatively lower share paid by big corporations. While individual taxpayers collectively fork out $330 billion annually through PAYG (Pay As You Go), large corporations contribute only around $100 billion. This imbalance…

Read MoreDo Foreign Investors Pay Capital Gains Tax in Australia?

In short: Yes. And there’s no escaping it. As a foreign property investor in Australia, you are subject to Capital Gains Tax (CGT). While you do not pay for the Medicare Levy, your taxes from any income as a non-resident still applies with the following income tiers: $0 – $135k = 30 cents to a…

Read MoreWhat Are the New Foreign Investor Tax Rules in Australia?

Are you a foreign investor in Australian property? If so, it is imperative that you understand your tax obligations in Australia to avoid penalties and unnecessary high tax debt. From JANUARY 1st, 2025, the Australian Tax Office (ATO) is expected to announce big changes on withholding tax that will affect all overseas investors. This article…

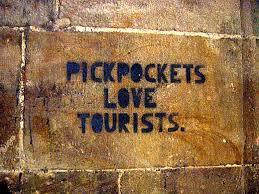

Read MoreAre You Planning A Trip Overseas?

Best Ways to Take Money Overseas Protect You Assets Has one of your children has decided to take a trip overseas, do you know the best ways to take money overseas? Read on so you can assist them with protection of their assets while they are abroad. In the past we’ve discussed the concept of…

Read MoreThe Guide To Teaching Children About Money

Teaching Kids the Value of Money How do we teach our children about the value of money? As parents we want our children to prosper with health, friendships, education and generally grow into strong, reliable adults. Yet we sometimes forget, until maybe too late that for our children to prosper we need them to understand…

Read MoreAsset Protection Can Save You Thousands Of Dollars

Are your business assets protected? As you know, asset protection for business is as important as managing them and protecting your future is just as important. If not more so, especially whilst building for your future. There are many ways to minimise your risk whilst reaping…

Read More