Are You Planning A Trip Overseas?

Best Ways to Take Money Overseas Protect You Assets

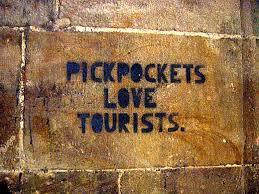

Tips for money safety when travelling abroad

Has one of your children has decided to take a trip overseas, do you know the best ways to take money overseas? Read on so you can assist them with protection of their assets while they are abroad.

In the past we’ve discussed the concept of money with our kids from preschool and taught them interest, savings plans and budgets and now. Much to our internal, fearful horror ……. they want to go abroad.

Of course we want them to have the time of their lives and drink in everything they see and do, yet we also want them to come home to no shocks from their bank statements, as variations in bank fees can be huge when travelling abroad using a credit or debit card. Here we provide some tips on how to help.

What are some safe ways to travel with money overseas?

A great way to start when considering your best ways to take money overseas; would be to have cash converted to the relevant currency of the country they will be visiting. If this is several places, then the suggestion would be to have small amounts of local currency for each stop to ensure the first couple of days are covered for the train, cab fares, food and drink without having to try and find a bank or ATM.

Safety around cash is essential. Obviously you don’t want them carrying too much cash around, but if kept in a money belt under their clothing along with any traveller’s cheques or cards, should be fairly safe. If at all possible it would be best to only carry what will be necessary for the day, plus a little extra, leaving the bulk in a safe at the accommodation. It’s probably also a good idea to have their own safety lock and code on the safe for extra security.

Travellers Cheques and Overseas Travel

Travellers cheques are also a very safe option and amongst best ways to take money overseas. They have been and will continue to be accepted in thousands of locations around the world. Should the cheques be lost or stolen, a phone call can see them replaced almost anywhere in the world within approximately 24 hours. Plus, they have no expiry date, therefore can be saved for future use, as long as they’ve been signed, recorded and the serial numbers saved.

Safety around credit and debits cards is also essential. The Commonwealth bank has a informative post at its website on “5 Top Money Travel Tips“. Informing banks prior to travel that they will be using the card would be to their advantage, otherwise the bank may decline a transaction deeming it unusual activity.

It’s also wise to find out the charges associated with withdrawing cash from ATM’s or paying for items with the card whilst overseas. Hidden commissions of up to 3% plus ATM fees can definitely put a hole in an already tight holiday or working budget. If your kids are aware of the charges before leaving on their holiday, at least informed decisions can be made around withdrawing cash where best possible for small purchases rather than paying by card each time and potentially doubling up on the original cost of the item.

What are some other money options rather than a credit card?

Another option around this would be the prepaid currency card, similar to travellers cheques, that when used converts on the spot the relevant currency and locked in exchange rate, ensuring to keep budgets under control. Another important component of the card is it is not connected to your banking transaction account; therefore, skimming or theft would be relatively low depending on the balance in the card.

There are many on the market and can sometimes be more expensive than using a debit card, however with the help of research and the internet, your child may find the perfect card with great exchange rates, no fees and smartphone access.

If you’re child or you yourself are planning a trip overseas for business purposes, keep in mind some expenses may be eligible to claim in your tax return, such as vehicle hire, taxi services, accommodation and consumables. However, this does depend on a number of factors. Give TJD Accounting Services a call before your next trip and we’ll run you through claimable items and the best way to keep track of your expenses.

Until next time.